Industry Knowledge

Cutting Down the Complexity of Compliance Outsourcing

Compliance outsourcing doesn’t have to be complex when engaged with a reliable outsourcing partner.

Compliance is a crucial aspect of business, especially in the FinTech space. It ensures that operations adhere to laws, regulations, and enterprise standards. However, apart from emerging challenges, FinTech organizations face constantly changing government regulations, making compliance a complex, difficult, and time-consuming process to follow.

Compliance violations can result in massive fines and damages to a company's reputation and partnerships. In 2020, Finbold.com reported a total of $11.11 billion in bank fines in the US alone.

To adapt, companies are rethinking their strategies and taking compliance outsourcing into consideration. 34% said that outsourcing should be part of their compliance management.

Deciding whether to keep compliance functions in-house or outsourced to a third party can be tricky; the compliance industry is filled with intricate regulatory requirements where violations can incur significant penalties and other negative consequences.

Balancing In-house and Outsourcing Compliance

Typically, organizations do both in-house and outsourcing when it comes to compliance. With each business being built differently with varying compliance requirements, a deliberate internal assessment is necessary to determine weaknesses or gaps in their operations, such as vacancies in compliance, privacy, or security officer roles.

Keeping up with compliance regulations requires more skills, deeper knowledge, and better technology, which can be expensive and challenging to build on your own. This is when consulting with compliance outsourcing financial services comes in. By working with an expert, you will significantly benefit from the insights and recommendations they provide.

Compliance outsourcing involves hiring a third party to manage particular compliance processes, allowing the company to adjust quickly to ever-changing regulations and avoid violations. This is one of the rising businesses in the BPO industry as more companies shift to financial technology.

Partnering with experienced outsourcing compliance financial services allows companies to adapt to regulation changes swiftly. With outsourcing, you can get expertise and tools, and be able to train your staff instantly. Other outsourced compliance services include compliance training seminars, candidate sanction screening, whistleblower hotlines, and other processes requiring around-the-clock posts.

When it comes to compliance, there is no one-size-fits-all strategy. What matters is that you lay a solid internal foundation and find the right balance for your organization.

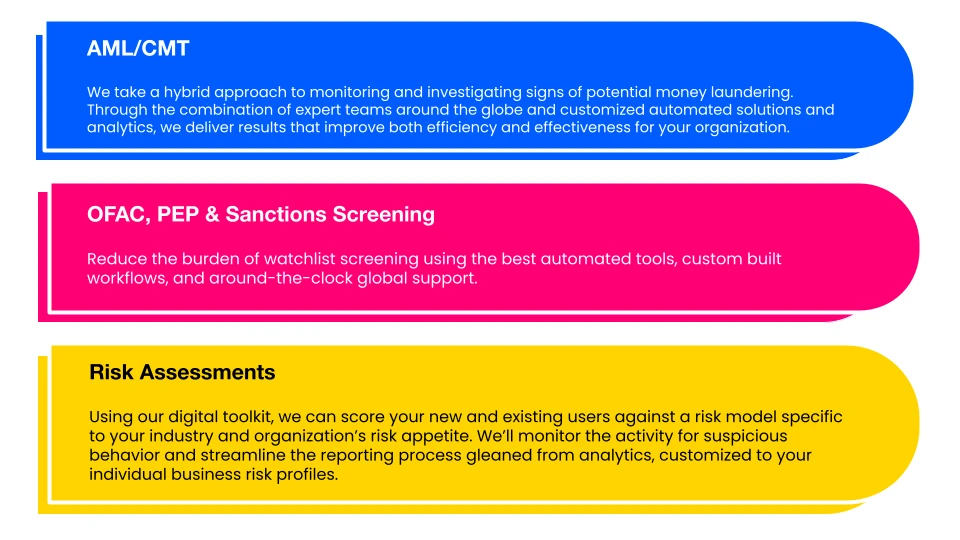

Commonly Outsourced Compliance Services

Compliance outsourcing companies offer different services. Below are some of the most widely used:

Anti-Money Laundering (AML) and Combating the Financing of Terrorism - Monitoring and investigating possible money laundering and terrorism financing incidents

Office of Foreign Assets Control (OFAC), Politically Exposed Person (PEP) & Sanctions Screening - Identifying people and businesses under sanctions and preventing their illegal transactions

Risk Assessment - Data and analytics of activities for suspicious behavior and strategizing reporting process

Advantages of Compliance Outsourcing

There are many advantages of outsourcing as it can deliver transformative results once you have a strong understanding of its dynamics:

1. Time and cost-effectiveness

- Building a specialized team from the ground up can be very costly and time-consuming as it would require detailed qualifications for hiring, additional training hours, and investment in tools. Compliance outsourcing financial services have the expertise and technology to help get you started immediately.

2. Pool of talents and resources

- Getting up to speed on the latest compliance trends and technology is easier with outsourcing companies because they already have the necessary resources, tools, talents, and partnerships to leverage at scale.

3. Efficiency and quality work

- Outsourcing compliance services are comprised of experts with extensive knowledge and experience in compliance. With such a partner, you can focus on other core business requirements and make compliance tasks more efficient and productive.

4. Compliance experts

- Since outsourcing partners have worked in their field throughout its transitions and progress, they have already developed extensive expertise in compliance and know its ins and outs. They will provide you with strategies and solutions in your best interests.

What to Find in an Outsourcing Partner

The key to finding the right compliance outsourcing partner is to be deliberate in assessing your requirements and fully understand what the third-party vendor can provide. Here are a few of the things you must check to determine which partner is suitable for your compliance needs:

1. Track Record

- A reliable compliance outsourcing partner has solid credentials and a deep understanding of multiple workflows within a program. It shows that they can plan and scale capabilities proactively.

2. Target Alignment

- Your prospective compliance outsourcing partner must have taken time to learn and understand your organization and your risk management and transaction monitoring processes. Right at the start of your partnership, prepare measurable deliverables and expectations, and ensure that all parties have taken all aspects of the business into consideration.

3. Available resources

- Outsourcing partners have the necessary skills and tools for your compliance requirements, but it is crucial to ensure that these cater to your specifications.

4. Culture and values

- Successful partnerships are built on a solid corporate culture and shared values. Partner with outsourcing organizations that recognize and honor your business’ principles.

Securing Compliance

Securing Compliance

Dubbed by the Everest Group as the World's Fastest Growing Business Process (outsourcing) Service Provider, TaskUs understands the need to always be a step ahead, especially in the ever-changing compliance landscape. We outsource financial services specially designed for neo-banks, fintechs, e-commerce marketplaces, and blockchain disruptors.

Compliance

Solutions simplify regulatory complexity. We deploy and scale AML/CFT compliance, sanctions screening, and enhanced due diligence teams that adapt to regulatory changes in real-time.

A UK-based challenger bank offering digital alternatives has been experiencing tremendous growth since its launch in 2015. It was time that they found an excellent compliance outsourcing partner to strengthen the relationship between the client and their customers, enforce a formidable process, and form the best possible team to protect and secure the customers’ data.

A key component of our compliance services training program was brand immersion. Prior to the training program, the client had sessions with our Learning Experience team to develop specific brand standards. The ultimate goal was to develop Teammates who are champions of financial literacy and are highly knowledgeable on the anti-money laundering act, different fraud processes and prevention, compliance, and digital banking in general.

TaskUs exceeded the following metrics:

We are confident in our strength in the compliance outsourcing space, enabling Us to deliver excellent results in terms of productivity, quality, and overall performance for various clients.

- 1^Cost of Compliance 2021: Shaping the Future

- 2^The Bank Fines in 2020

References

We exist to empower people to deliver Ridiculously Good innovation to the world’s best companies.

Useful Links