Industry Knowledge

Fraud Prevention Reimagined: Implementing Wellness Interventions to Combat Fraud

Fraud impacts businesses of all types and sizes. A PwC report (2022) noted that the number of organizational frauds peaked in 2020-2022 compared to 20 years ago. An estimated over $4.7 trillion has been reportedly lost to fraud, based on a study across 133 countries (Association of Certified Fraud Examiners, 2022). Partly due to the pandemic, the advent of platforms and the growing reliance on digital systems has significantly altered the landscape of business operations. This shift has also led to an increase in platform fraud risks. Unfortunately, nearly one-third of platform fraud cases were found to be carried out internally by employees, as revealed in the PwC report (2022).

Tech organizations and service providers are rising to this challenge by investing more in technical guardrails to mitigate internal incidents. The fraud detection & prevention market has a projected compound annual growth rate (CAGR) of 22.8% between now and 2029 (Fortune Business Insights, 2022).

Nevertheless, these efforts only offer a partial solution, largely overlooking the crucial human factors contributing to employee fraud. A recent research publication (Pusch & Holtfreter, 2021) that consolidated findings from over 60 studies and highlighted that individual-level factors contribute to corporate white-collar crime just as much as if not more than, organizational characteristics. One promising solution is psychologically informed wellness interventions that help transform the nature of these factors from being deceitful to being conscientious, thus, nipping fraud in the bud.

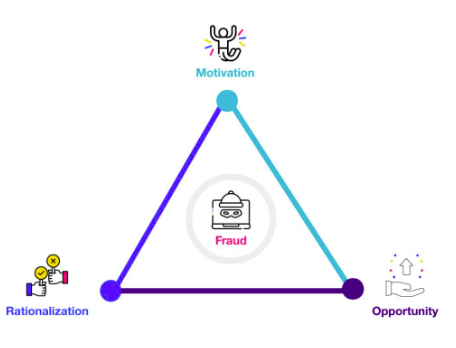

According to the Fraud Triangle, proposed by criminologist Donald Cressey as early as the 1950s, two of the three necessary antecedents to fraud are psychological, indicating the need for psychologically rooted remedies. Understanding the motivations behind fraudulent acts is essential.

Motivation - Often, individuals are driven by a desperate desire to achieve something beyond their legitimate means, such as acquiring a commodity that exceeds their purchasing power.

Rationalization - Rationalization involves viewing one’s fraudulent act as a means to justify the end or to compensate for some perceived unfairness like retaliating against cost-cutting measures.

Opportunity - When the actor has a sufficient motivation that helps them rationalize the maliciousness of fraud to themselves, they seek out an opportunity (e.g., having access to customer information) to complete the fraud. As a result, companies enforce fraud policies and security measures; however, these are insufficient to decrease the prevalence of corporate fraud, as they are external to the individual psychological basis of fraud.

The virtual environment of platforms amplifies the psychological distance between the fraud perpetrator and the victim, minimizing feelings of guilt. The interplay of motivation and rationalization intensifies in this depersonalized environment, increasing the opportunity to exploit. This is where wellness interventions can play a critical role in reducing the risks of internal platform fraud. By addressing and transforming the motivational and rationalization factors from being deceitful to conscientious, wellness interventions can nip fraud in the bud.

Effective wellness sessions—facilitated by trained psychologists and coaches—can help employees develop and prioritize intrinsic motivation (e.g., personal talents/skills/virtues) over extrinsic motivation (e.g., rewards/status) in choosing a course of action. This shift in mindset will minimize the risks of harmful actions. Second, wellness programs can equip individuals with adaptive coping mechanisms to help them manage stressors that may otherwise lead to or exacerbate the rationalization of committing fraud. The General Strain Theory in relation to corporate crime, by Robert Agnew and others (2009), explains that stress on account of losses, failed goals, dissatisfaction with circumstances, or unfair treatment by others leads to negative emotions and frustrations. If not tended to in an adaptive fashion, these experiences may pressure an individual to resolve the situation and emotions by any means, including maladaptive actions such as fraud. Wellness interventions, especially if done in a preventive fashion, can optimize brain function while lessening the stress response.

A lack of organizational support and empathy during challenging times stimulates the motivation and rationalization of fraudulent acts. As a result, the financial and reputational costs to companies are manifold. Organizations that implement psychology-informed, anti-fraud wellness interventions to mitigate psychological risks alongside policy and security efforts can diminish or reverse incidents of fraud.

At TaskUs, our Wellness and Resiliency department is committed to creating and sustaining comprehensive, global psychological health and safety programs for our employees. Our programs are guided by evidence-based psychology and grounded in neuroscience. We offer workplace wellness programs such as 24/7 psychological health services, resiliency skill acquisition sessions, and more. We also provide consultancy services to support organizations in combating fraud effectively.

References

We exist to empower people to deliver Ridiculously Good innovation to the world’s best companies.

Services