Industry Knowledge

Enhanced Due Diligence: Mitigating Risks and Maintaining Integrity

Manage risk and maintain compliance by prioritizing identity verification and enhanced due diligence.

- The Importance of Identity Verification and EDD in Financial Crime Compliance

- The Challenges of Identity Verification and EDD

- The Role of Outsourced Providers in Financial Crime Compliance Work

- The Benefits of Partnering with Outsourced Financial Crime Compliance Providers

- Redefine Risk + Response with Us

Financial crimes are becoming more complex and sophisticated, increasing the threat to financial institutions’ stability and reputations. With the demand for a better customer banking experience, companies are now prioritizing identity verification and enhanced customer due diligence (EDD). However, conducting adequate identity verification and EDD work can be a complex and resource-intensive task, requiring specialized expertise and tools—both are significant investments.

This article will explore the importance of prioritizing identity verification and EDD in a financial crime compliance program and maximizing its benefits while staying cost-efficient. We will also examine available services and providers, analyze their role in helping financial institutions manage risk, comply with regulatory requirements, and improve compliance performance.

The Importance of Identity Verification and EDD in Financial Crime Compliance

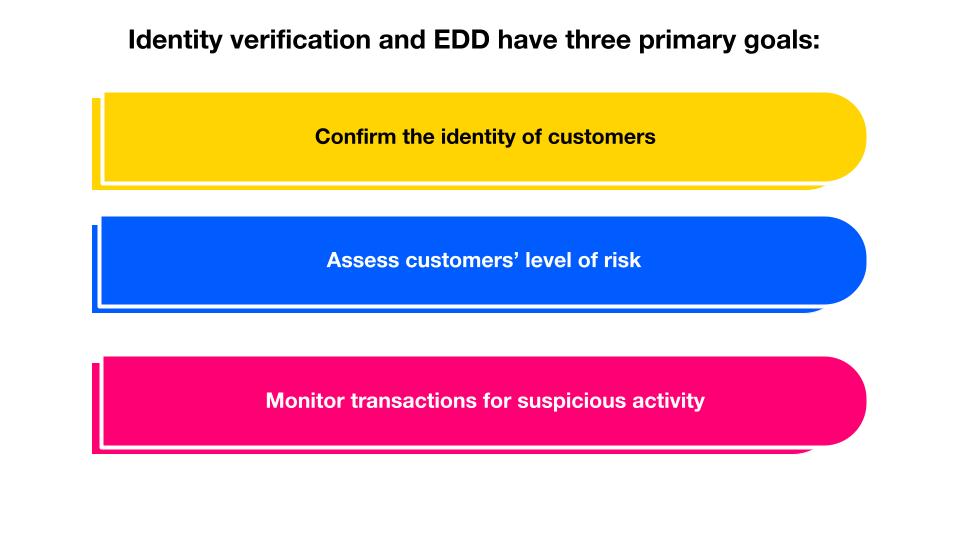

Identity verification and enhanced due diligence(EDD) are vital in maintaining the financial system's integrity.

Identity verification involves collecting and validating personal information to ensure that customers are who they claim to be. On the other hand, EDD goes beyond primary identity verification, gathering additional information about high-risk individuals and organizations.

The primary purpose of identity verification and EDD is to understand your customer’s needs and anticipated financial activity. It is also a key pillar in any US compliance program, allowing institutions to comply with regulatory requirements, such as Know Your Customer (KYC) and its online counterpart, eKYC, and Anti-Money Laundering (AML) laws.

By complying with these guidelines, financial institutions can prevent illegal activities and maintain the integrity of the financial system.

Failure to conduct adequate identity verification and EDD work can result in severe consequences, including regulatory penalties and loss of business.

The Challenges of Identity Verification and EDD

Conducting effective identity verification and EDD work is complex. Financial institutions require specialized knowledge and resources to implement processes effectively:

- Access to databases for verifying customer information

- Financial institutions require secured access to databases with customer data such as credit scores and banking activity. This can pose a challenge due to restrictions, budget constraints, and specialized expertise.

- Specialized training for employees who conduct identity verification and EDD work

- Providing training for employees may be hindered due to a lack of available in-house resources such as specialized technology and subject matter experts.

- Ongoing monitoring of customer activity to identify potential risks

- To identify potential risks like unusual transactions and suspicious activity, financial institutions require the use of state-of-the-art technology that complies with regulatory requirements.

Prioritizing the implementation of effective identity verification and EDD processes is a must to ensure compliance with regulations and protect customers and the financial system as a whole. This is where compliance outsourcing comes in.

The Role of Outsourced Providers in Financial Crime Compliance Work

Outsourced financial crime compliance providers offer specialized services to help financial institutions manage their compliance obligations and mitigate the risk of financial crime.

Identity verification |

Outsourced providers help financial institutions verify the identity of new and existing customers, using various data sources and technology to ensure accuracy and compliance with regulatory requirements. |

Enhanced Due Diligence (EDD) |

Outsourced providers can conduct EDD on higher-risk customers, using advanced techniques such as data analytics and investigative research to identify potential risks and red flags. |

Risk assessments |

Providers can conduct comprehensive risk assessments of financial institutions' compliance programs, helping identify gaps and improvement areas. |

Maintaining impartiality and transparency is essential in financial crime compliance work. Outsourced providers can help achieve this by partnering with independent third parties to provide ongoing oversight of compliance programs, ensuring that policies and procedures are followed correctly.

In addition to providing core compliance services, outsourced providers can offer valuable insights and recommendations for improving compliance performance and managing risk.

- Proactive recommendations:

- Providers can offer proactive recommendations for policy and procedural changes to improve compliance performance and reduce financial crime risk. Providing forward-thinking direction for standard operating procedure changes can help reduce risk.

- Data analytics:

- Outsourced financial crime compliance providers can leverage data analytics to identify emerging risks and trends, providing banking institutions with beneficial solutions and guidance for managing risk.

- Training and education:

- Outsourced providers can also offer training and education programs to help financial institutions stay up-to-date with changing regulations and best practices and increase financial crime compliance knowledge.

Overall, outsourced financial crime compliance providers can offer financial institutions a range of specialized identity verification services and support, helping manage risk, maintain compliance, and improve operational efficiency.

The Benefits of Partnering with Outsourced Financial Crime Compliance Providers

Conducting adequate identity verification and EDD work can be complex, resource-consuming, and confusing. As a result, many financial institutions turn to third-party financial crime compliance providers to help them tackle these challenges, such as keeping up with evolving regulatory requirements and staying ahead of emerging risks.

Outsourcing financial crime compliance work to specialized providers can offer several benefits to financial institutions:

Cost savings |

Outsourcing is more cost-effective than building an in-house compliance team and acquiring the necessary tools and technology. |

Access to expertise |

Specialized risk & response teams from third-party compliance providers have deep knowledge and expertise in financial crime compliance and are up-to-date with evolving regulations and best practices. |

Improved efficiency |

Compliance providers can provide more efficient processes, including using advanced technology and data analytics to identify potential risks and suspicious activity. |

Reduced risk |

Specialized providers can help banking institutions reduce the risk of breaches, threats, and non-compliance penalties. |

These third-party providers can offer advanced tech-enabled solutions, including AI and machine learning, to help identify and manage risks. Additionally, outsourcing providers equip companies with the flexibility to scale their compliance program based on their needs and budget.

Outsourcing financial crime compliance work to third-party providers can help financial institutions reduce the risk of non-compliance, regulatory fines, and reputational damage while improving operational efficiency and enhancing their overall compliance program.

Redefine Risk + Response with Us

Recognized as the Everest Group’s World’s Fastest Business Process (outsourcing) Service Provider in 2022 and highly rated in the Gartner Peer Insights Review, TaskUs offers innovative and comprehensive solutions to seamlessly outsource your financial operations while providing the highest level of security and maintaining stringent compliance.

Our experienced team of certified risk management experts works closely with our clients to understand business needs, identify potential risks and vulnerabilities, and develop a customized strategy to mitigate those risks. We leverage cutting-edge technology and data analytics to monitor and detect potential threats and provide proactive recommendations to improve compliance performance and manage risk.

Whether you're looking to outsource specific aspects of your risk and compliance program or need a complete end-to-end solution, we are committed to delivering world-class services to drive your success.

- 1^Advanced Analytics and Innovation in Financial Crime Compliance

References

We exist to empower people to deliver Ridiculously Good innovation to the world’s best companies.

Services