As the Streaming Wars wind down, we can confidently look back at them from a 30,000 foot view and see them for what they were: a regional, internecine conflict. The major players have established themselves for the next decade and won’t be going anywhere. Netflix, HBO Max, Disney+ (including ESPN and Hulu), Prime Video, and even smaller powers such as Paramount+ and PlutoTV and Apple TV+, have established dominance over their territory with sufficient defensive moats (content + pricing + UI) to maintain the status quo.

But while the Entertainment Industry (a.k.a. Hollywood) remains fixated on the so-called Streaming Wars, there’s a galactic armada that has been orbiting the Earth—and that armada belongs to an interstellar superpower called the Gaming Industry. By 2028, the gaming industry is set to reach $545.9 billion, That’s a magnitude of ten times over the global box office in 2021 of $21.3 billion. To Gaming, Hollywood wouldn’t even show up on the radar.

Nowhere was this more evident than at a Streaming conference when streaming executives were asked who they saw as their biggest competitors for viewer eyeballs, and they cited each other. They didn’t see that they were a fish in a drying tidal pool while Megalodons like TikTok and Epic Games and Roblox patrolled the ocean. Ok, enough with the analogies.

Today, Gaming IS entertainment. Gaming IS streaming. Twitch recorded a whopping 23.3 billion hours of live viewership in 2021, and it is expected to grow with its return to the Xbox dashboard and integration in Amazon Luna. In addition, the global esports market reached $1.1 billion in value, largely thanks to sponsorships and advertising. Streaming contributes to the growth with 465.1 million people with a 6.7% growth year on year.

It is also big tech’s new battleground. At the beginning of the year, we witnessed three major acquisitions: Take-Two Interactive, Microsoft, and Sony. Streaming giant Netflix is also testing the waters with its recent purchase of Night School Studio, and the battle in the gaming arena is only getting fiercer. Gaming is expanding like a supernova across the celestial plane, and its gravitational pull is inescapable, driving innovation across the tech ecosystem. Gaming IS web3.

For gamers and game developers, the concept of the metaverse isn’t new. Fortnite and Roblox have been metaverses before the word was vaunted at Tech Conferences and in the media. Remember “Ready Player One?” We are basically there. Every other industry is noticing.

Evolve and Conquer

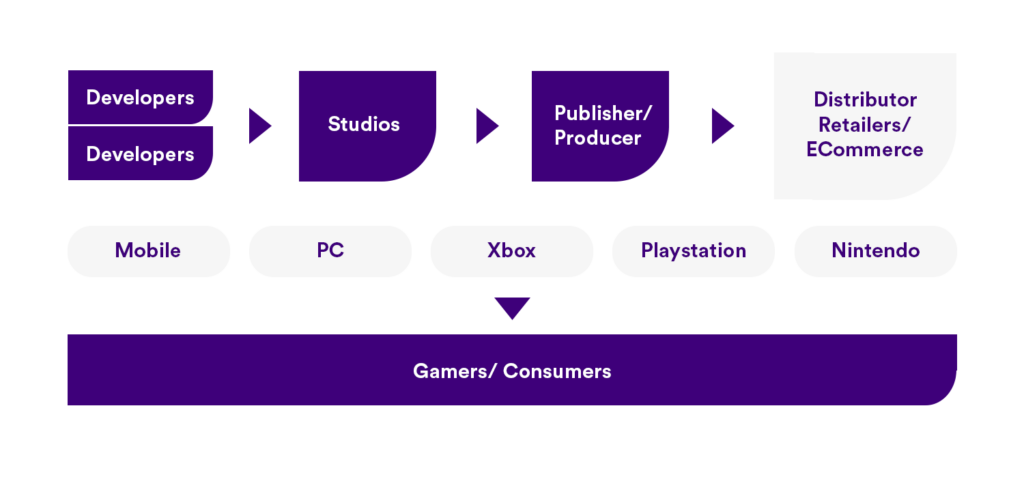

In the old days, the gaming industry functioned similarly to show business. There were studios and producers (developers). Developers would pitch their game to studios, or sometimes studios would bring on developers to build out a project. If the game testing looked promising, investment piled in, retailers and platforms (PC and consoles) signed up for distribution, and brick-and-mortar retailers sold it in a beautifully packaged box, and we gamers threw that cartridge or CD onto our platform of choice. It looked something like this:

Elements of this ecosystem still exist, but digital evolution built entire economies out of this world.

We first saw this in popular MMOs and Battle Royales such as World of Warcraft, Fortnite, and COD Warzone. But with the advent of new technologies and industries brought into these gaming worlds, we are very close to a world where I can dress my avatar in Gucci loafers, and roll up in a Tesla-branded Star Wars X-Wing.

If They Build It, They Will Come

Games are all about world-building. This is fundamentally changing the way gamers interact with the game and with each other. As of 2021, the lifetime value of a gamer was estimated at $58,000 in a lifetime ($76 per month) due to related expenses such as internet, in-app purchases, new games, and equipment. It is projected that the market value of in-game purchases is projected to surpass $74.4 billion in 2025.

To illustrate the change in gamers’ spending habits, we compare the former traditional model versus the current ecosystem. In the former, a gamer buys an XBox and goes to a brick-and-mortar store to buy a game. To encourage players to buy more, consoles would upgrade accessories, produce a next-generation machine, or offer more games. The whole process is rather simple, with minimal transactions.

Today, players subscribe to a multitude of apps/ platforms to enhance their experience

- Gaming Platform - to access the game and buy updates and new content/storylines/ digital assets

- Social Media Messaging Apps - to collaborate with friends

- Streaming Apps - to live stream sessions or watch others' sessions

- Game Forums - to learn tips and tricks, mods, and DLCs

- NFT Platforms - to look for or make proprietary digital art, exchange or trade them with others, and use them as currency.

With gamers spending more, they expect excellent player support. This support could come from any of the elements of the ecosystem: the game publisher or studio, the console platform, the hardware manufacturer, the streaming app, the messaging app, and in-game Player touchpoints are multiplying rapidly..

There’s a need for safe spaces to collaborate, chat, and play. Abuse and harassment continue to cause serious problems in the gaming arena. Two-thirds of gamers in the US have experienced severe harassment while playing online. Privacy and security issues have also become prevalent, especially with the boom of eCommerce, financial data, PII, and NFTs.

Enter Player 2: TaskUs

Gaming platforms face challenges in a multitude of areas providing player support with providing proper game support.

- Gaming companies are slow to respond, with an average response time of 39 hours

- 31% outright ignore customer emails

- Only 53% of gaming companies across the globe have a readily accessible email address. Of those, 76% ignore a simple customer service email asking for a game recommendation

- 46% of gaming companies did not provide an accessible support email address

- Only 13% of companies send an auto-response to acknowledge customer emails

It takes a true gamer to truly understand the help fellow gamers need. At TaskUs, our Teammates are fans and players of the games, and our diverse portfolio of industry clients makes it possible for Us to personalize the support that you need. We take support to the next level with our robust expertise in omnichannel support and community moderation.

Gaming is transcending, bringing convergence of siloed metaverses among various industries. Elevating experiences would require more work, but the desired endgame remains the same—you win.

References

We exist to empower people to deliver Ridiculously Good innovation to the world’s best companies.

Services